Reverse VAT. Are you Ready?

February 26, 2021 - Construction & Engineering

What is it? With effect from Monday 1 March 2021 fundamental changes to the VAT system will take place. Described...

What is it?

With effect from Monday 1 March 2021 fundamental changes to the VAT system will take place.

Described as ‘Reverse VAT’ these changes are going have an immediate impact on the UK Construction Industry.

The new regime will affect any construction firms which provide specified services which are governed by the Construction Industry Scheme and will only apply for businesses or individuals who are registered for VAT. For a quick guide to which services are/are not subject to ‘reverse’ VAT see Appendix 1 below.

The change is that rather than a supplier of services issuing a VAT invoice and then accounting to HMRC, the recipient of the service has to ‘charge’ itself the VAT and account directly to HMRC.

The purpose is to avoid the supplier receiving VAT and not then accounting to HMRC.

This ‘reverse’ regime will only apply to inter-business supplies and not for for businesses who are providing a service directly to the consumer. Likewise, it will not apply to any projects where the service is zero rated for VAT.

Impact on the Construction Industry

Recipients

For those companies who are recipients of services which are subject to this new regime, you will have to ensure that you have procedures in place to record where VAT is payable, be able to account to HMRC and then pay the VAT. This is an administrative exercise but should be capable of being undertaken in conjunction with payments under the CIS.

Where the supplier is VAT registered then the recipient will either account to HMRC and pay VAT to HMRC or if the ‘reverse’ regime does not apply then pay the VAT to the supplier.

Suppliers

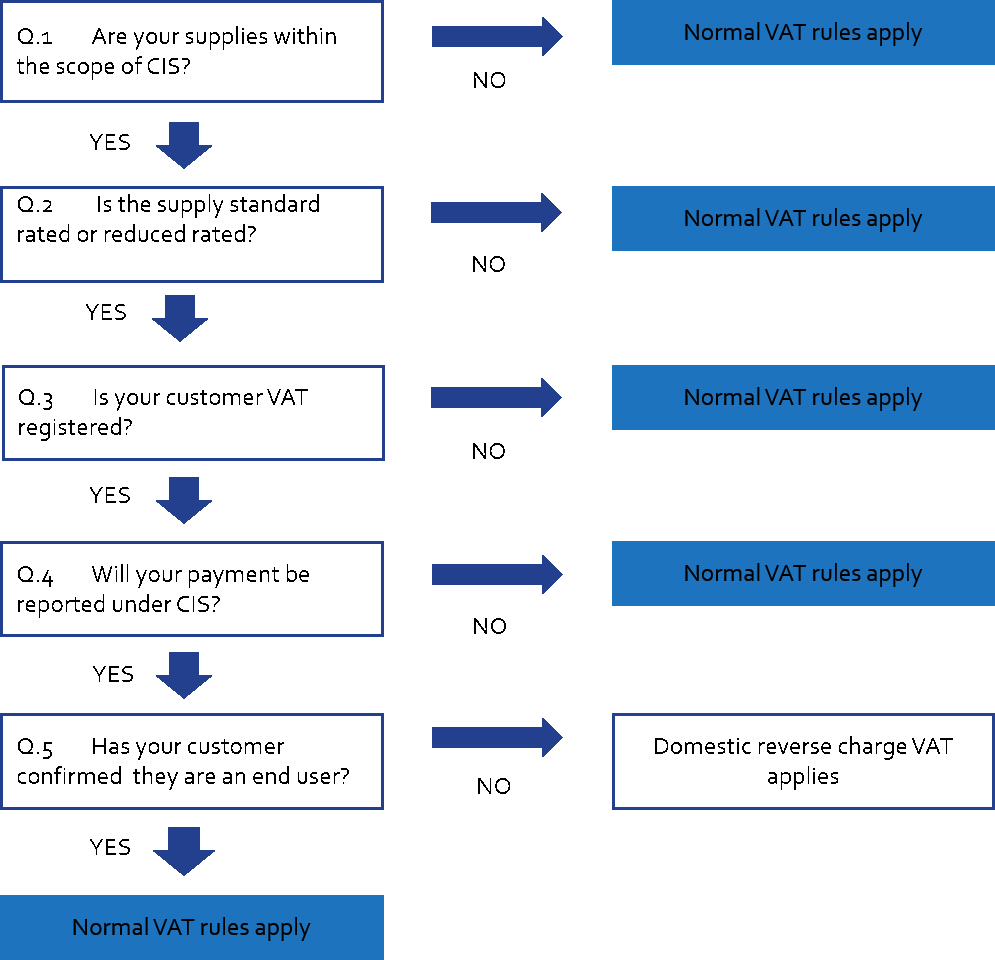

For suppliers there will also be an administrative process but this more onerous. It is for the supplier to determine whether the ‘reverse’ regime applies and if it does then the supplier has to notify the recipient. This will require the supplier to review each live contract and then set up a procedure for each new contract entered into. Please see the flowchart at Appendix 2 for a basic guide.

Cashflow

The unintended but obvious effect of this change to the VAT system is that suppliers who relied upon VAT payments to aid cashflow between VAT quarterly payments will now be denied the opportunity to bolster their working capital on a short term basis. Undoubtedly the shortfall to HMRC will be reduced but many in the Construction Industry will find it hard to survive without their VAT receipts supporting their cashflow.

It is not too late to implement the necessary administrative adjustments to comply with the new regime. If you have any doubts then you should contact your accountant.

Lewis Cohen

25 February 2021

If you have any construction related enquiries, please contact any member of the team as follows (all phone numbers are forwarded to our mobiles when we are out of the office):

| Simon Rawlins | simon.rawlins@bracherrawlins.co.uk | 020 7400 1539 |

| Lewis Cohen | lewis.cohen@bracherrawlins.co.uk | 020 7400 1547 |

| George Masefield | george.masefield@bracherrawlins.co.uk | 020 7400 1524 |

| Hannah Slaughter | hannah.slaughter@bracherrawlins.co.uk | 020 7400 1536 |

| Olivia Maurier | olivia.maurier@bracherrawlins.co.uk | 020 7400 1525 |

Appendix 1: Construction Operations inside and outside of the new scheme

Inside the new scheme

- Decorating or painting the inside or the exterior surfaces of any building or structure

- Site clearance, excavation, tunnelling and boring, laying of foundations, erection of scaffolding, site restoration, landscaping and the provision of roadways and other access works, earth-moving

- Constructing, repairing, altering, demolishing, extending or dismantling buildings or structures, including offshore installation services

- Reservoirs, pipelines, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- Installing heating, lighting, air-conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection systems in any building or structure

- Internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- Altering, repairing, extending, demolishing, constructing of any works forming, or planned to form, part of the land, including walls, roadworks, power lines, electronic communications equipment, aircraft runways, railways, inland waterways, docks and harbours

Outside the new scheme

- Drilling for, or extracting, oil or natural gas

- Installing seating, blinds and shutters

- Installing security systems, including burglar alarms, closed circuit television and public address systems

- Making, installing and repairing art works such as murals, sculptures and other artistic items

- Signwriting and erecting, installing and repairing advertisements and signboards

- architectural or surveying work, or of building, engineering, interior or exterior decoration and landscape consultants

- Manufacturing components for lighting, air conditioning, ventilation, heating, power supply, drainage, sanitation, water supply or fire protection systems, or delivery any of these to site

- Manufacturing building or engineering components or equipment, materials, plant or machinery, or delivering any of these to site

- Extracting minerals and tunnelling, boring or construction of underground works for this purpose

Appendix 2: Flowchart to determine applicability of Reverse VAT

Use this flowchart to decide whether to apply normal VAT rules or apply the VAT reverse charge for Construction:

Let’s start a conversation

If you’d like to have a chat about how we can assist you or your business, please give us a call on +44 (0)207 404 9400 or use our Contact Us form.